Running a small business—whether it’s a local shop, a consulting firm, or a service provider—requires dedication, strategy, and significant money.

While you love serving your customers and honing your craft, managing the financial side can be daunting, especially when tax season rolls around. But here’s the good news: understanding and correctly applying tax deductions can significantly reduce your tax burden, freeing up capital to invest back into your business’s growth.

This guide breaks down key deductions available to nearly every small business owner to help you maximize your tax savings.

IRS Guidelines: What Qualifies as a Business Expense?

The foundational principle the Internal Revenue Service (IRS) uses to determine if an expense is deductible is that it must be both “ordinary and necessary” for the trade or business, as defined under Internal Revenue Code 162.

- Ordinary: An expense is ordinary if it is common and accepted in your specific industry or business type.

- Necessary: An expense is necessary if it is helpful and appropriate for your business. It doesn’t have to be absolutely essential.

Expenses that meet this definition are generally deductible. However, if an expense has both a business and a personal component (like a cell phone or a vehicle), you can only deduct the business portion.

For detailed guidance, always refer to official IRS publications, such as Publication 334, Tax Guide for Small Business.

Deductible Expenses: Your Small Business Toolkit

The following deductions are common across most industries and business types:

1. Home Office Deduction

Do you have a dedicated, exclusive space in your home used regularly and exclusively for your business? You may be eligible to deduct a portion of your housing expenses. You can choose between two methods:

- Regular Method: Calculate the percentage of your home’s square footage used for business and apply that percentage to home expenses (e.g., mortgage interest, rent, utilities, insurance, repairs, depreciation).

- Simplified Method: Deduct a prescribed rate per square foot ($5 for 2024), up to 300 square feet, which simplifies the calculation and record-keeping.

2. Equipment & Technology

Investing in the assets required to run your operation—from manufacturing equipment to computer hardware—is a deductible expense.

- Small Items: Supplies and smaller tools can typically be deducted entirely in the year of purchase.

- Larger Assets (Capital Expenses): For big-ticket items like machinery, vehicles, furniture, or computer systems, the cost is recovered over time through depreciation.

- Section 179 and Bonus Depreciation: These special provisions allow you to deduct a much larger portion, or even the full cost, of qualifying equipment in the year you place it in service, accelerating your tax savings.

3. Internet, Phone, and Utilities

In today’s connected world, reliable communication is essential.

- Business Portion: You can deduct the business-use percentage of your overall internet and phone bills.

- Dedicated Lines: If you have a dedicated business phone line or internet connection used only for the business, it is fully deductible. Similarly, a percentage of your business utilities (if separate from your home office utilities) are deductible.

4. Advertising & Marketing

Getting your product or service in front of customers is a necessary cost of doing business. Deductible expenses include:

- Digital/Traditional Ads: Paid ads on social media, Google, radio, print, or billboards.

- Website Costs: Hosting, domain registration, and professional design fees.

- Promotional Materials: Business cards, flyers, signage, and brochures.

5. Travel and Vehicle Expenses

Business-related travel that is ordinary and necessary is deductible. This includes:

- Business Trips: Airfare, lodging, and transportation costs for out-of-town trips to meet clients, attend trade shows, or visit suppliers.

- Vehicle Use: You can deduct vehicle expenses using one of two methods:

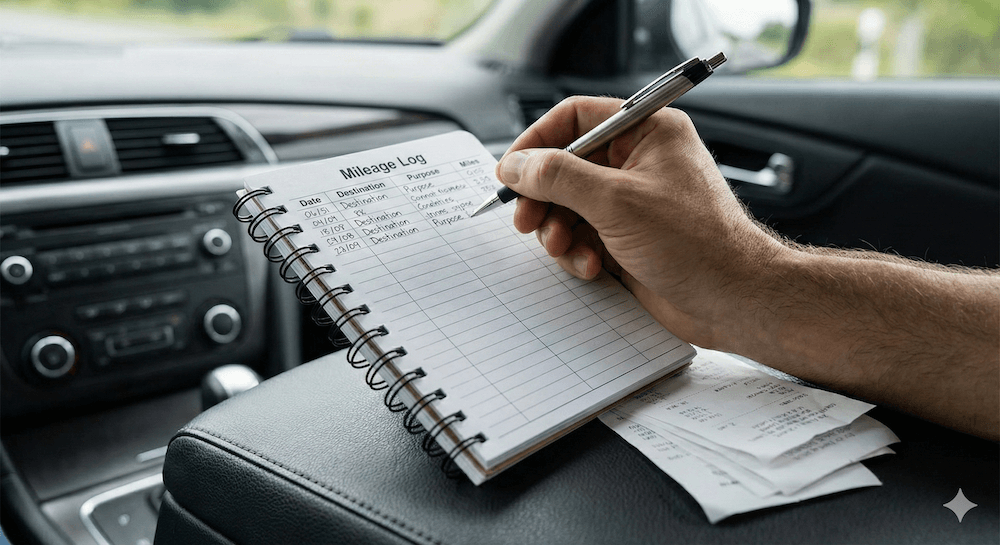

- Standard Mileage Rate: Deduct a set rate per business mile driven (plus tolls and parking). Requires a meticulous contemporaneous mileage log.

- Actual Expenses: Deduct the actual costs of gas, oil, repairs, insurance, etc., multiplied by the business-use percentage, which must be tracked via a log.

- Meals: Generally, meals while traveling for business are 50% deductible.

6. Professional Services & Fees

As your business grows, you’ll need expert help to manage various aspects. Deductible fees include:

- Accountants & Tax Professionals: Fees for tax preparation, bookkeeping, and business consulting.

- Legal Counsel: Fees for contract review, intellectual property protection, and business formation.

- Virtual Assistants/Contractors: Payments to independent contractors who perform tasks for your business (reported on Form 1099, if applicable).

7. Training and Education

Costs associated with maintaining or improving skills specifically required in your current business are deductible.

- Courses and Seminars: Industry-specific training, certification courses, and professional development workshops.

- Subscriptions: Trade publications, industry reports, or continuing education services.

8. Rent and Leases

If you operate out of a separate commercial location (e.g., a retail storefront, a warehouse, an office space), the costs are deductible.

- Business Rent: Rent paid for your primary place of business is a major deduction.

- Equipment Leases: Payments for leased equipment, such as copiers, tools, or delivery vehicles.

9. Business Insurance

Premiums paid for necessary business insurance are generally deductible. This includes:

- Liability Insurance: General liability, professional liability (malpractice), or product liability.

- Property Insurance: Coverage for your commercial building, equipment, and inventory.

- Health Insurance: Self-employed individuals may also deduct premiums paid for health insurance for themselves and their family via the Self-Employed Health Insurance Deduction, subject to certain rules.

10. Office Supplies and Operations

Don’t overlook the day-to-day costs of running an office.

- Consumables: Paper, printer ink, pens, cleaning supplies, and postage.

- Software Subscriptions: Accounting software, CRM tools, or industry-specific design software.

- Bank/Financial Fees: Business bank account fees, credit card annual fees, and merchant processing fees.

🔒 IRS Guidelines: The Crucial Rules on Documentation

The most crucial rule for any small business deduction is substantiation. If the IRS questions a deduction, the burden of proof is on you, the taxpayer, to show that the expense was valid.

Strict Substantiation Requirements 274(d)

For certain expense categories—namely Travel, Meals, and Business Gifts—the IRS requires strict substantiation under Internal Revenue Code 274(d). For these, you must prove the Amount, Time/Place, Business Purpose, and Business Relationship (for meals/gifts).

Specific Thresholds for Receipts:

- Lodging: A receipt showing the name, location, and dates is always required, regardless of the cost.

- Other Expenses (Travel, Meals, etc.): A receipt or bill is required for any expense of $75 or more.

- Note: For expenses under $75, a receipt is not required, but you must still record the business details (Amount, Time, Place, Purpose) in a log or record-keeping system.

- Business Gifts: The deduction is limited to $25 per recipient per year, and a receipt is required regardless of the amount.

Key Documentation to Keep

- Receipts and Invoices: Essential for all purchases. For credit card statements, you need the underlying receipt showing the item purchased.

- Mileage Logs: Required for vehicle deductions, detailing the date, destination, purpose, and miles driven for every business trip.

- Account Books: A reliable and organized recordkeeping system (e.g., accounting software or ledgers) that summarizes your transactions.

Record Retention: The IRS generally advises keeping records for at least three years from the date you filed your original return.